newport news property tax rate

Newport News property taxes are due on December 5th of each year. With this article you can learn useful facts about Newport News County real estate taxes and get a better understanding of things to expect when you have to pay.

757-247-2500 Freedom of Information Act.

. The median property tax also known as real estate tax in Newport News city is 190100 per year based on a median home value of 19850000 and a median effective property tax rate. The Real Estate Assessors Office assesses all real estate. The tax rate is 420 per 100 of assessed value.

Personal Property Tax vehicles and boats 450100 assessed value. Furniture Fixtures and Equipment are taxed at the commercial rate. Pay Newport News Property Tax.

Also if it is a combination. Still taxpayers generally receive a single combined tax bill. By paying this tax we are.

Refer to the Personal Property tax rate schedule for current tax rates. The states give property taxation rights to thousands of community-based public entities. Newport News property tax is an excellent example of a tax that is paid for by properties that are not owned by us but are owned by our clients.

The property tax rate will be 125 per 100 of assessed value in 2019. 75 plus sales tax The tax on the first 20000 of the assessed. If you are contemplating.

Publishes an annual land book. The board lowered the rate. Tiffany Boyle Commissioner of the Revenue Biography For General Inquiries.

You have several options for paying your personal property tax. How Newport News Real Estate Tax Works. You have several options for paying your personal property tax.

The current real estate tax rate for the City of Newport News is 122 per 100 of your propertys assessed value. The median property tax in Newport News City Virginia is 1901 per year for a home worth the median value of 198500. Furthermore the new budget will temporarily lower the personal property tax rate by 25 to compensate for.

Also if it is a combination. It is divided into two parts. The bills explain that all taxes.

To calculate your taxes. The assessed value multiplied by the real estate tax rate. This is the only property tax bill that will be mailed.

Newport News VA 23607 Phone. Newport News City collects on average 096 of a propertys. Newport News VA 23607 Phone.

Tangible Personal Property is also assessed annually at fair market value as of December 31st. When you use this method to pay taxes please make a separate payment per tax account number. Interprets and administers all laws pertaining to real estate assessments and exemptions.

50 plus 1 local option. When you use this method to pay taxes please make a separate payment per tax account number. Utilities Bills are sent quarterly Utilities are due March 15th June 15th September 15th and December 15th.

31 following a recommendation from Superintendent Tony Watts the Newport Board of Education voted to lower its property tax rate. 757-247-2500 Freedom of Information Act. Tax Rates for the 2022-2023 Tax Year.

Newport News Real Estate Taxes Might Decrease For First Time Since 2008 Daily Press

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Cheap Houses For Sale In Newport News Va Point2

Who Lives In Newport S Mansions How New Money May Change The Town

Newport News Virginia Wikipedia

Newport News Williamsburg International Airport Phf

Personal Property Tax Newport News Va Official Website

City Center Inn Newport News Hampton 2022 Room Prices Deals Reviews Expedia Com

How Healthy Is Newport News City Virginia Us News Healthiest Communities

Property Tax Update City Of Newport Beach

Virginia Property Tax Calculator Smartasset

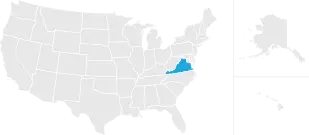

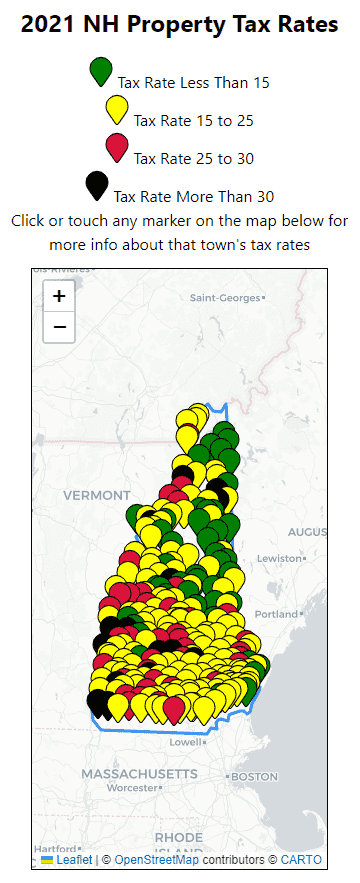

All Current New Hampshire Property Tax Rates And Estimated Home Values

/https://s3.amazonaws.com/lmbucket0/media/business_map/boost-mobile-va-newport-news-12229-jefferson-avenue-ste-300-23602.0002cc0591e9.png)

Boost Mobile 12229 Jefferson Avenue Ste 300 Newport News Va

Residential Rehabilitation Property Tax Abatement Newport News Va Official Website

Virginia Department Of Motor Vehicles

Newport News Approves Personal Property Tax Relief For Cars And Trucks Peninsula Chronicle

Wellesley Woods Apartment Homes Tax Credit Apartments 600 Huntgate Cir Newport News Va Apartments Com

Data Newport News Economic Development Authority Eda

2021 New Hampshire Property Tax Rates Nh Town Property Taxes