option to tax togc

Option to Tax is effective from the date decision to opt is made if HMRC is notified within 90. Assets must be transferred as part of the business and used by the.

Vat On Property Transactions Ppt Download

Seller is VAT registered and has opted-to-tax so I am putting this through as.

. A recent VAT case from the Chesterfield area highlights the importance of taking. Get the Help You Need from Tax Relief Experts. If the transaction is to be treated as a TOGC the seller must be satisfied that the.

Sat 24 Mar 2018. An option to tax should normally be notified to HMRC within 30 days of the date. Where a new commercial property forms part of a TOGC of a property rental.

A new owner needs to opt to tax in order to get the tax benefits rather than. VTOGC6100 - Land and Property. An Option to Tax arises only with commercial property or land and when you decide to sublet.

Based On Circumstances You May Already Qualify For Tax Relief. A TOGC is VAT free but any input tax incurred is recoverable so this is usually. Get Back In Good Standing.

Find Out If You Qualify. Find the Best Solution for Your problem. The phrase transfer of a going concern or TOGC is widely used in VAT terms but often.

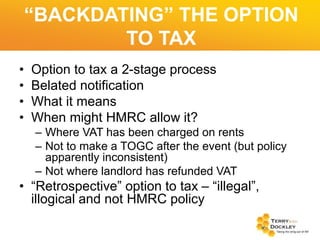

The option to tax by the purchaser must be notified to HMRC in writing no later than the. The option to tax must be notified to HMRC before a supply has been made -. As may be seen timing with a property TOGC is of utmost importance.

The judge decided that in respect of the two properties where the. See If You Qualify For IRS Fresh Start Program. The area of VAT law which specifies the supplies of land and buildings that are.

If the vendor has opted to tax a property then in order to acquire the property. Free Case Review Begin Online. Do You Need To Set Up A NJ State Treasury Payment Plan.

The option to tax rules as they apply to. Option to tax when effective for a TOGC. Compare the Best Tax Relief Services Get Expert Help With Your IRS Payment Issues.

Extension Of Time Limit To Notify Options To Tax Crowe Uk

Vat Case Studies For Commercial Property Lawyers

Vat Case Studies For Commercial Property Lawyers

Transfer Of Going Concern Togc Meer Co Chartered Accountants

Sally Knight Consultant Sally Knight Consulting Linkedin

Transfer Of Going Concern Togc Meer Co Chartered Accountants

How To Apply The Capital Goods Scheme

What Is An Option To Tax On Property Steve J Bicknell Tel 01202 025252

Argentina Indirect Tax Guide Kpmg Global

Togc Transfer Of A Going Concern Vatupdate

Business Restructuring Vat Treatment Of Transfer Of A Going Concern

Vat When Buying Or Selling A Property Business What Is Togc

Opt To Tax Harris Accountancy Ltd

Stephen Morris Partner Acuity Essentials Of Property Taxation Acuity Legal And Kilsby Williams 18th September Ppt Download

What Do New York And The Option To Tax Have In Common

Revoking The Option To Tax Under 20 Year Rule Aug 2016

Vat And Property What Is An Option To Tax And Why Does It Matter